irc sec 179 limitation for kubota skid steer 1. Limitations under Section 179 may apply. See a qualified tax professional for advice on your specific situation. 2. See owner’s manual for details. Learn about the essential factors to consider when comparing mini excavator brands, such as durability, history, price, attachments, and engine capabilities. Explore the .

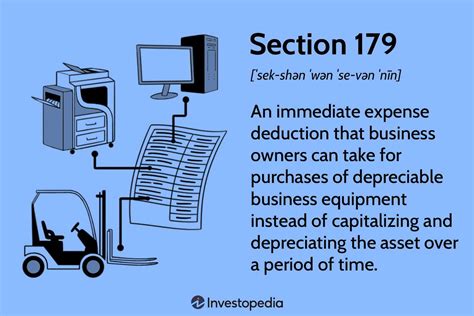

0 · what is section 179

1 · skid steer attachment tax deduction

2 · section 179 skid steer tax deduction

Mini digger hire prices; INFORMATION; Blog; CONTACT; 07893943917; . At Mini bulldozer .

1. Limitations under Section 179 may apply. See a qualified tax professional for advice on your specific situation. 2. See owner’s manual for details.Learn how you can get tax relief thanks to your Skid Steer Attachment or Heavy Equipment purchases this year. Utilize the Section 179 tax deduction to save money for your business.The limit for total equipment purchases is ,890,000. Once you exceed this amount, the deduction begins to phase out. If you hit the spending cap, you may still qualify for Bonus . According to the IRS under the 2018 tax reform, and subject to limitations, businesses are able to deduct the full purchase price for qualifying equipment – yes, that could .

For U.S.-based businesses, Section 179 of the IRS Tax Code allows a company to write off up to 100% of the cost of new and used qualifying equipment purchases. For the 2024 filing, the deduction limit is ,180,000, with a .

The deduction limit is ,160,000 for 2023. This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2023, the equipment must . When both 100% first-year bonus depreciation and the Section 179 deduction privilege are available for the same asset, you generally should claim 100% bonus depreciation, because there are no limitations on that .

top 5 skid steer brands machines4umachines4u mag amp

Skid steers, compact excavators, and track loaders - you name it, we have it. Our selection of construction equipment consists of the SSV Series, KX Series, U Series, and SVL Series. .

Spending Limits of Section 179 for 2024. Section 179 comes with specific limits. For 2024, businesses can deduct up to ,220,000 in equipment purchases. However, this benefit .Learn how Section 179 and Bonus Depreciation work and how they may change in 2023. Find out the limits, caps and tips for deducting the purchase price of qualifying equipment.1. Limitations under Section 179 may apply. See a qualified tax professional for advice on your specific situation. 2. See owner’s manual for details.

Learn how you can get tax relief thanks to your Skid Steer Attachment or Heavy Equipment purchases this year. Utilize the Section 179 tax deduction to save money for your business.

The limit for total equipment purchases is ,890,000. Once you exceed this amount, the deduction begins to phase out. If you hit the spending cap, you may still qualify for Bonus Depreciation. For 2024, bonus depreciation is 80% of the cost of new equipment, applied after the Section 179 deduction. According to the IRS under the 2018 tax reform, and subject to limitations, businesses are able to deduct the full purchase price for qualifying equipment – yes, that could include the Kubota you purchased in 2024!For U.S.-based businesses, Section 179 of the IRS Tax Code allows a company to write off up to 100% of the cost of new and used qualifying equipment purchases. For the 2024 filing, the deduction limit is ,180,000, with a spending cap of ,940,000.The deduction limit is ,160,000 for 2023. This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2023, the equipment must be financed or purchased and put into service between January 1, 2023 and the end of the day on December 31, 2023.

When both 100% first-year bonus depreciation and the Section 179 deduction privilege are available for the same asset, you generally should claim 100% bonus depreciation, because there are no limitations on that break. However, in some situations, Section 179 expensing can be advantageous.Skid steers, compact excavators, and track loaders - you name it, we have it. Our selection of construction equipment consists of the SSV Series, KX Series, U Series, and SVL Series. Let’s take a look at what models these series offer, along with how you can take advantage of Section 179 tax deductions when purchasing new equipment!

Spending Limits of Section 179 for 2024. Section 179 comes with specific limits. For 2024, businesses can deduct up to ,220,000 in equipment purchases. However, this benefit starts to phase out once total equipment purchases exceed ,050,000, with the deduction reducing dollar-for-dollar.Learn how Section 179 and Bonus Depreciation work and how they may change in 2023. Find out the limits, caps and tips for deducting the purchase price of qualifying equipment.1. Limitations under Section 179 may apply. See a qualified tax professional for advice on your specific situation. 2. See owner’s manual for details.Learn how you can get tax relief thanks to your Skid Steer Attachment or Heavy Equipment purchases this year. Utilize the Section 179 tax deduction to save money for your business.

The limit for total equipment purchases is ,890,000. Once you exceed this amount, the deduction begins to phase out. If you hit the spending cap, you may still qualify for Bonus Depreciation. For 2024, bonus depreciation is 80% of the cost of new equipment, applied after the Section 179 deduction. According to the IRS under the 2018 tax reform, and subject to limitations, businesses are able to deduct the full purchase price for qualifying equipment – yes, that could include the Kubota you purchased in 2024!For U.S.-based businesses, Section 179 of the IRS Tax Code allows a company to write off up to 100% of the cost of new and used qualifying equipment purchases. For the 2024 filing, the deduction limit is ,180,000, with a spending cap of ,940,000.

skid steer solutions canada

The deduction limit is ,160,000 for 2023. This deduction is good on new and used equipment, as well as off-the-shelf software. To take the deduction for tax year 2023, the equipment must be financed or purchased and put into service between January 1, 2023 and the end of the day on December 31, 2023.

When both 100% first-year bonus depreciation and the Section 179 deduction privilege are available for the same asset, you generally should claim 100% bonus depreciation, because there are no limitations on that break. However, in some situations, Section 179 expensing can be advantageous.

Skid steers, compact excavators, and track loaders - you name it, we have it. Our selection of construction equipment consists of the SSV Series, KX Series, U Series, and SVL Series. Let’s take a look at what models these series offer, along with how you can take advantage of Section 179 tax deductions when purchasing new equipment! Spending Limits of Section 179 for 2024. Section 179 comes with specific limits. For 2024, businesses can deduct up to ,220,000 in equipment purchases. However, this benefit starts to phase out once total equipment purchases exceed ,050,000, with the deduction reducing dollar-for-dollar.

skid steer solutions tiller

what is section 179

Battery-Electric Compact Excavator. Featuring state-of-the-art lithium-ion battery technology, the conventional tail-swing E19e provides the same power as its diesel-powered equivalents, with near-instantaneous torque. Pay as low as .

irc sec 179 limitation for kubota skid steer|what is section 179