how long can you depreciate a skid steer Learn how you can get tax relief thanks to your Skid Steer Attachment or Heavy Equipment purchases this year. Utilize the Section 179 tax deduction to save money for your business. Find out how much it costs to rent a mini excavator by city, size, and duration. Compare prices for 4,000 lb, 6,000 lb, and 8,000 lb mini excavators in different locations across the U.S.

0 · skid steer attachment tax deduction

1 · section 179 skid steer deduction

2 · equipment depreciation rules

3 · depreciation for construction equipment

Additional information. KAB 415: Popular seat, fits many excavators and some motor graders. Mechanical suspension. Front control recline. 2.5″ height adjustment. Front control tilt (multi function bottom cushion adjustment) Midback. Dual comfort arms. Headrest. Double locking slides below suspension. Komatsu seat, black cloth only.

Learn how you can get tax relief thanks to your Skid Steer Attachment or Heavy Equipment purchases this year. Utilize the Section 179 tax deduction to save money for your business.

mini excavator contractors brisbane

Suppose you purchase a new attachment for your skid steer for ,000. Without Section 17.Suppose you purchase a new attachment for your skid steer for ,000. Without Section 179, you would typically depreciate that equipment over several years, writing off a portion each . Equipment purchases made before the end of the year qualify for Section 179 and bonus depreciation on 2021 taxes as long as the equipment is put into service by midnight .

skid steer attachment tax deduction

For U.S.-based businesses, Section 179 of the IRS Tax Code allows a company to write off up to 100% of the cost of new and used qualifying equipment purchases. For the 2024 filing, the deduction limit is ,180,000, with a . Section 179 of the Internal Revenue Service tax code allows businesses of all types to deduct the full purchase price, up to ,160,000 for qualifying depreciable assets, including .

Learn how to depreciate capital assets, such as equipment, buildings, and vehicles, using the Modified Accelerated Cost Recovery System (MACRS). Find out how to compute depreciation, .Bonus depreciation is offered some years, and some years it isn’t. Right now in 2023, it’s being offered at 80%. The most important difference is both new and used equipment qualify for the . Businesses are now able to deduct the full purchase (or lease) price for qualifying equipment and/or software bought or financed during the tax year. See how you can benefit . With standard depreciation you take a smaller deduction over a longer period of time. Bonus depreciation is similar to Section 179 but has changed year to year. For example, .

section 179 skid steer deduction

equipment depreciation rules

Generally, you can write off the entire purchase this year if you only spend ,050,000 on heavy equipment in 2022. If your company pays more than ,700,000, the .

Learn how you can get tax relief thanks to your Skid Steer Attachment or Heavy Equipment purchases this year. Utilize the Section 179 tax deduction to save money for your business.

Suppose you purchase a new attachment for your skid steer for ,000. Without Section 179, you would typically depreciate that equipment over several years, writing off a portion each year. But with Section 179, you can deduct the full ,000 in the year you buy it, immediately reducing your taxable income.

Equipment purchases made before the end of the year qualify for Section 179 and bonus depreciation on 2021 taxes as long as the equipment is put into service by midnight December 31.For U.S.-based businesses, Section 179 of the IRS Tax Code allows a company to write off up to 100% of the cost of new and used qualifying equipment purchases. For the 2024 filing, the deduction limit is ,180,000, with a spending cap of ,940,000. Here’s what . Section 179 of the Internal Revenue Service tax code allows businesses of all types to deduct the full purchase price, up to ,160,000 for qualifying depreciable assets, including new and used construction equipment such as excavators, skid steers, and wheel loaders.Learn how to depreciate capital assets, such as equipment, buildings, and vehicles, using the Modified Accelerated Cost Recovery System (MACRS). Find out how to compute depreciation, choose a method, and claim deductions on your tax return.

Bonus depreciation is offered some years, and some years it isn’t. Right now in 2023, it’s being offered at 80%. The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is “new to you”), while Bonus Depreciation has only covered new equipment only until the most . Businesses are now able to deduct the full purchase (or lease) price for qualifying equipment and/or software bought or financed during the tax year. See how you can benefit from Section 179 tax incentives designed to help small businesses.

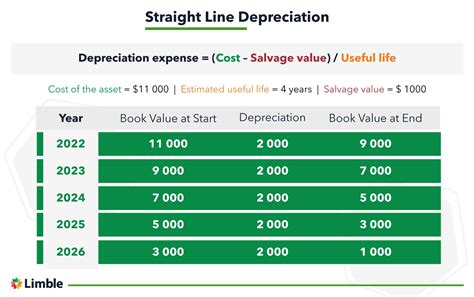

With standard depreciation you take a smaller deduction over a longer period of time. Bonus depreciation is similar to Section 179 but has changed year to year. For example, in past years you could only apply the deduction to new equipment. Generally, you can write off the entire purchase this year if you only spend ,050,000 on heavy equipment in 2022. If your company pays more than ,700,000, the deduction phases out, and after you've spent ,780,000, you won't receive a .

Learn how you can get tax relief thanks to your Skid Steer Attachment or Heavy Equipment purchases this year. Utilize the Section 179 tax deduction to save money for your business.Suppose you purchase a new attachment for your skid steer for ,000. Without Section 179, you would typically depreciate that equipment over several years, writing off a portion each year. But with Section 179, you can deduct the full ,000 in the year you buy it, immediately reducing your taxable income. Equipment purchases made before the end of the year qualify for Section 179 and bonus depreciation on 2021 taxes as long as the equipment is put into service by midnight December 31.

For U.S.-based businesses, Section 179 of the IRS Tax Code allows a company to write off up to 100% of the cost of new and used qualifying equipment purchases. For the 2024 filing, the deduction limit is ,180,000, with a spending cap of ,940,000. Here’s what .

depreciation for construction equipment

Section 179 of the Internal Revenue Service tax code allows businesses of all types to deduct the full purchase price, up to ,160,000 for qualifying depreciable assets, including new and used construction equipment such as excavators, skid steers, and wheel loaders.Learn how to depreciate capital assets, such as equipment, buildings, and vehicles, using the Modified Accelerated Cost Recovery System (MACRS). Find out how to compute depreciation, choose a method, and claim deductions on your tax return.Bonus depreciation is offered some years, and some years it isn’t. Right now in 2023, it’s being offered at 80%. The most important difference is both new and used equipment qualify for the Section 179 Deduction (as long as the used equipment is “new to you”), while Bonus Depreciation has only covered new equipment only until the most . Businesses are now able to deduct the full purchase (or lease) price for qualifying equipment and/or software bought or financed during the tax year. See how you can benefit from Section 179 tax incentives designed to help small businesses.

With standard depreciation you take a smaller deduction over a longer period of time. Bonus depreciation is similar to Section 179 but has changed year to year. For example, in past years you could only apply the deduction to new equipment.

The Dingo TX 427 is a versatile and powerful compact utility loader with a narrow track design that fits through standard 36" gates. It has a 27 hp Kohler engine, a 4-pump hydraulic system, and a low impact footprint for turf protection.

how long can you depreciate a skid steer|skid steer attachment tax deduction